Business Registration

Step-by-Step Guide

This guide provides a structured approach to starting various types of businesses, such as a branch office, a representative office, a private limited liability company or a company limited by shares as a subsidiary, a general partnership, a limited partnership, or a sole proprietorship for registration in Taiwan.

Step 1: Decide on a Business Structure

Step 2: Get Chinese and English Company Name Approval

Step 3: Find Premises

Step 4: Obtain Registration, Incorporation and Permit

Step 5: Taxation

Step 6: A case study: Registering a Private Limited Liability Company

Step 5: Taxation

Overview

In general Taiwan Tax Laws and Tax Rate, either Income Tax or VAT (GST), are reasonable and friendly, but Taiwan is still a developing country, in many different aspects. And tax is one of them, in many cases, tax litigation arising from the situation that has not been clearly defined by tax law, and this is always a red tape when a company applies the tax law to a transaction, without consulting reliable tax advisor.

For international transaction, a company must evaluate tax compliance from the point of view of Taiwan tax law, tax incentive scheme, tax treaty and take into account of the proficiency of local tax officer, in your jurisdiction, about cross boarder transaction.

In order to avoid or at least to reduce the tax risks of a foreign investment, a foreign investor or his/her tax agent should always maintain a smooth relationship and communication channel with the local tax authorities, either in Ministry level or at city level.

Taiwan has one of the most competitive tax regimes in the world and a number of interesting tax incentive schemes to attract investors. However, any research prior to where to establish a business operation would not be complete without a thorough investigation of the tax impact. This should reflect the following:

- the tax aspects of the investor's home country

- the tax aspects in the country where the investment is made

- how the above tax regimes interact

- the tax impact to the individual taxation of executives

Taiwan adopts Residence Basis of Taxation for business entity; business legal entity will be taxed on world-wide income. Foreign source income is taxable; however, tax paid in other tax jurisdiction could be income tax credit to offset Taiwan income tax.

Taiwan Income Tax Rates

- Business Income Tax is 20%

- Resident income is 5% to 40%

- Non-residential individual salary or remuneration is taxed at 6% or 18%.

- Non-residential Director's fees, Professional fee, consultation fees & all other income are taxed at 20%.

Business Income Tax Rates and Exemption for Companies

Definition and Filing

A company qualifies for taxation in Taiwan if:

- Its business entity is incorporated or registered under the Companies Act of Taiwan.

- a foreign company registered in Taiwan such as a branch

- a foreign company incorporated or registered outside Taiwan

Filing

For companies with a regular financial calendar year ended the business operation period for each year on 31 December.

Companies with a Special financial year ended the business operation period for each year on the last day of a specific month during a year.

Each company has to pay an estimate of its taxable income known as provisional income tax in September.

Furthermore, each company is required to declare its income by completing a Business Income Tax Return for company each year. The due date for filing of Business Income Tax Return for each year is 31 May of each year.

Proper records of its financial transactions and retain the source documents, accounting records and schedules, bank statements and any other records of transactions connected with your business must be maintained and a company must retain the records for a period of five years from the relevant year.

Tax Rates

Business Income Tax rate is 20% on net profit before income tax, Net profit before income tax less than TWD120,000 are exempt . Taiwan adopts a one-tier corporate tax system under which tax paid by a company on its taxable income is the final tax. All dividends paid by a company to a Taiwan tax resident are exempt from tax in the hands of the shareholders; however, dividend appropriated to foreign shareholder is subject to 10% to 20% withholding tax, depending on tax treaty.

A company is taxed at a flat rate of 20% on its net profit before income tax

- income accruing in or derived from Taiwan

- income received in Taiwan from outside Taiwan

i. gains or profits from any trade or business

ii. income from investment such as dividends, interest and rental

iii. royalties, premiums and any other profits from property

iv. other gains of an income nature

Capital gain such as gains on sale of fixed assets, except land, or gains on foreign exchange on capital transactions is taxable.

Deductions

- Productivity and Innovation Credit

- Business expenses

- Unutilised losses, qualified may be carried forward to 10 years.

- donations

Tax Rates and Exemptions for General Partnerships

Definition and Filing

As a partnership is not an entity in law, the partnership does not pay income tax on the income earned by the partnership. Instead, each partner will be taxed on his or its share of the income from the partnership based on his personal income tax rate.

Filing

The partnership should decide on its accounting period when it first starts business. The accounting period is the period of trade for which the business calculates profits or losses.

A partnership must file Business Income Tax return in May, but it does not pay income tax on partnership; and it must prepare a Divisible Profit or Loss statement of the business which is then allocated to the partners.

Tax Rates and Deductions are the same as a company, but no exemption

Tax Rates and Exemptions Sole Proprietorship

Definition and Filing

A sole proprietorship is regarded as a self-employed receiving business income derived from carrying on a trade, a business, a profession, or a vocation. Business income is taxable in the sole-proprietor's name and needs to be reported in his/hers individual tax return, where it becomes subject to personal income tax rates.

Filing

The partnership should decide on its accounting period when it first starts business. The accounting period is the period of trade for which the business calculates profits or losses.

A sole proprietorship must file Business Income Tax return in May, but it does not pay income tax on sole proprietorship.

Tax Rates and Deductions are the same as a company, but no exemption

Value Added Tax (VAT) - Goods and Service Tax (GST)

Businesses need to register for VAT when their start to operate it business. VAT registration is mandatory.

In general the Value Added Tax (VAT)) standard rate of 5% is levied on:

- the import of goods (collected by Taiwan Customs)

- supplies of goods and services in Taiwan

For the Exporting of Goods and International Services VAT Rate is zero.

Exemptions:

- sales and leases of unfurnished residential properties

- the provision of most financial services

- Sale of goods delivered from overseas to overseas outside the scope of the VAT Act

A VAT registered business must credit VAT output tax when making the sales and debit VAT input tax on business purchases and expenses (including import of goods). At the end of each accounting period a VAT return must be submitted to VA office. The difference between output tax and input tax is the net VAT payable to, VAT credit or refundable VAT.

Exemptions, to name a few:

- The sale of land.

- The water supplied to farmland for irrigation.

- The medical services, medicine, ward lodging and meals provided by hospitals, clinics and sanitariums.

- The social welfare services.

- The education services offered by schools, kindergartens.

- Publication which are textbooks authorized by education authorities for use at various levels of schools.

- The goods or services sold by student-run shops of vocational schools which do not serve outsiders.

- Newspapers, magazines, newsletters, advertisements, television and broadcasting programs produced.

- The proceeds from goods sold in tenders, charity sales and charity shows held by charity.

- Services rendered by post and telecommunication offices.

- The goods or services sold by peddlers or hawkers.

- Feed and unprocessed raw agricultural, forestry, fishing and livestock products, and by-products; the agricultural, forestry, fishing and livestock products, and by-products of farmers' and fishermen's harvests sold by farmers and fishermen.

- The fish caught and sold by fishermen.

- The sales of rice and wheat flour and the service of husking rice.

- The sales of fixed assets which are not regularly traded by business entities which compute their business tax according to Section 2 of Chapter 4.

- The sales of weapons, warships, aircraft, tanks and reconnaissance communication equipment for military use to defense agencies.

- Fertilizer, pesticides, veterinary drugs, agricultural machinery, transportation equipment for farmland.

- Fishing boats for coastal or inshore fishery and machinery, equipment, nets and fuel oil used by fishing boats.

- Gold bars, gold bricks, gold foil, gold coins and gold ornaments, excluding the processing fee.

- The research services supplied by scientific or technological institutions which are established under the approval of the government.

- The sales amount of operating financial derivatives products, corporate bonds, financial bonds.

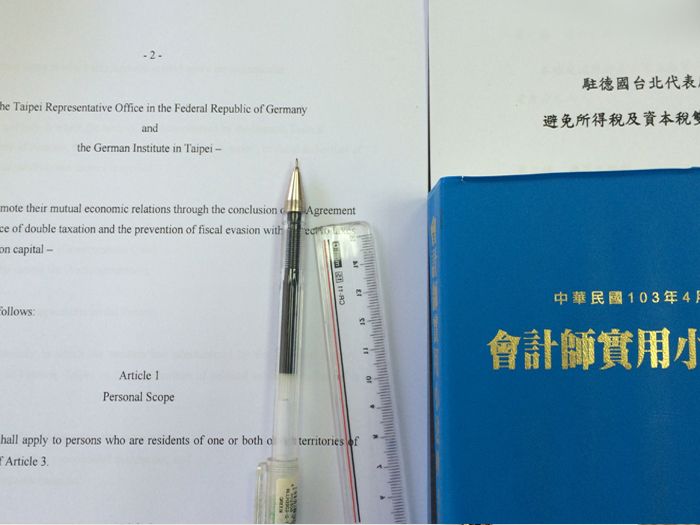

Tax Treaty

Overview

Taiwan has income tax treaties with a number of foreign countries; the tax treaties follow OECD Model Tax Convention on Income and on Capital. Under these treaties, residents (not necessarily citizens) of foreign countries are taxed at a reduced rate, or are exempt from Taiwan income taxes on certain items of income they receive from sources within Taiwan. These reduced rates and exemptions vary among countries and specific items of income.

If the treaty does not cover a particular kind of income, or if there is no treaty between your country and Taiwan, you must pay tax on the income in the same way and at the same rates as a Taiwan individual or a business entity.

Treaty provisions generally are reciprocal (apply to both treaty countries). Therefore, a Taiwan citizen or tax resident who receives income from a treaty country and who is subject to taxes imposed by foreign countries may be entitled to certain credits, deductions, exemptions, and reductions in the rate of taxes of those foreign countries.

Foreign taxing authorities sometimes require certification from Taiwan Government that an applicant filed an income tax return as a Taiwan citizen or tax resident, as part of the proof of entitlement to the treaty benefits. Taiwan tax office requires the same certification, if a foreign individual or a business entity claims tax treaty benefits or exemption according to tax treaty for the income from the source of Taiwan.

Taxpayer should carefully examine the specific treaty articles that may apply to find if you are entitled to a:

- tax credit,

- tax exemption,

- reduced rate of tax, or

- other treaty benefit or safeguard.

You may refer “Regulations Governing Application of Agreements for the Avoidance of Double Taxation with Respect to Taxes on Income”, when you plan to claim tax treaty benefits or exemption.

List of ROC Taiwan Double Taxation Agreements

| Countries |

Date of Signature |

Effective Date |

| Singapore |

1981/12/30 |

1982/1/1 |

| Indonesia |

1995/3/1 |

1996/1/12 |

| South Africa |

1994/2/14 |

1996/9/12 |

| Australia |

1996/5/29 |

1996/10/11 |

| New Zealand |

1996/11/11 |

1997/12/5 |

| Vietnam |

1998/4/6 |

1998/5/6 |

| Gambia |

1998/7/22 |

1998/11/4 |

| Swaziland |

1998/9/7 |

1999/2/9 |

| Malaysia |

1996/7/23 |

1999/2/26 |

| Macedonia |

1999/6/9 |

1999/6/9 |

| The Netherlands |

2001/2/27 |

2001/5/16 |

| UK |

2002/4/8 |

2002/12/23 |

| Senegal |

2000/1/20 |

2004/9/10 |

| Sweden |

2001/6/8 |

2004/11/24 |

| Belgium |

2004/10/13 |

2005/12/14 |

| Denmark |

2005/8/30 |

2005/12/23 |

| Israel |

2009/12/18 |

2009/12/24 |

| Paraguay |

1994/4/28 |

2010/6/3 |

| Hungary |

2010/4/19 |

2010/12/29 |

| France |

2010/12/24 |

2011/1/1 |

| India |

2011/7/12 |

2011/8/12 |

| Slovakia |

2011/8/10 |

2011/9/24 |

| Switzerland |

2007/10/8 |

2011/12/13 |

| Germany |

2011/12/19 |

2012/11/7 |

| Thailand |

1999/7/9 |

2012/12/19 |

| Kiribati |

2014/5/13 |

2014/6/23 |

| Luxembourg |

2011/12/19 |

2014/7/25 |

| Austria |

2014/7/12 |

2014/12/20 |

Tax Incentive Schemes for Investors

- Participating in a major infrastructure project, exempted from income tax for a maximum period of 5 years.

- Participating in a major infrastructure project, 5% to 20% of the certain expenditures incurred against the income tax.

- A biotech and new pharmaceuticals company, 35% of the amount of funds invested for R&D and personnel training against income tax.

- Investment on a public biotech and new pharmaceuticals company for a period of 3 years, 20% of the investment may be income tax credit.

- Stock issued by a biotech and new pharmaceuticals company to high-level executives and technology investors in return for their knowledge and technology shall be excluded from the amount of their individual or business income tax.

- Companies limited by shares may credit up to 20% of the amount of funds invested for construction of new towns against income tax.

- Company limited by shares operates in a designated tax-reduction area may credit up to 20% of the total amount of investment for brand-new machines, equipment and buildings against income tax.

- Company limited by shares invests in the urban renewal business on designated area by City or County; the legal entity shareholder may credit up to 20% of the investment against income tax.

- Tourism enterprises may credit 10% to 20% of the expenses for international tourism and promotion campaigns against the income tax payable.

- Companies may credit up to 15% of the amount of funds invested for R&D having industrial innovation nature against income tax payable.

- Foreign enterprise or a branch office process goods in the free trade zone, the income derived from exporting the finished goods is exempt from income tax.

|