Business Registration

Step-by-Step Guide

This guide provides a structured approach to starting various types of businesses, such as a branch office, a representative office, a private limited liability company or a company limited by shares as a subsidiary, a general partnership, a limited partnership, or a sole proprietorship for registration in Taiwan.

Step 1: Decide on a Business Structure

Step 2: Get Chinese and English Company Name Approval

Step 3: Find Premises

Step 4: Obtain Registration, Incorporation and Permit

Step 5: Taxation

Step 6: A case study: Registering a Private Limited Liability Company

Steps 6: Case Study

Taiwan Private Limited Liability Company – Registration, Tax and Compliance

The Private Limited Liability Company (LTD) is the most common legal form of business entity for foreign investors in Taiwan; it is easily established and incurs a minimum of expenses. The shareholder or director can be a foreigner; no Taiwanese citizen is required to hold any equity or managerial or directing position in an LTD.

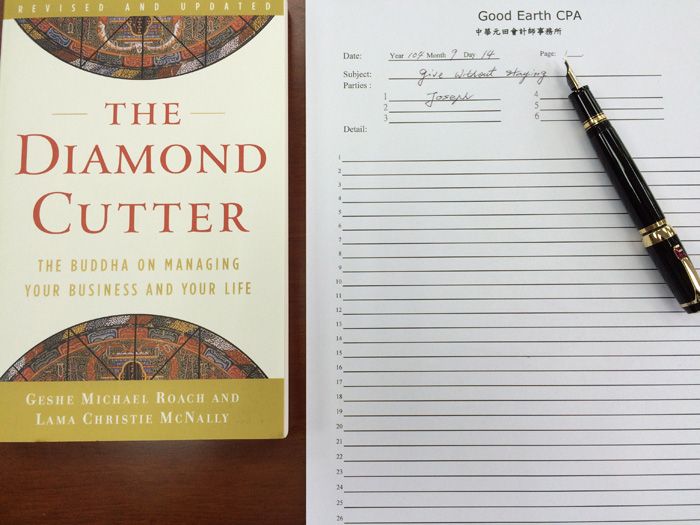

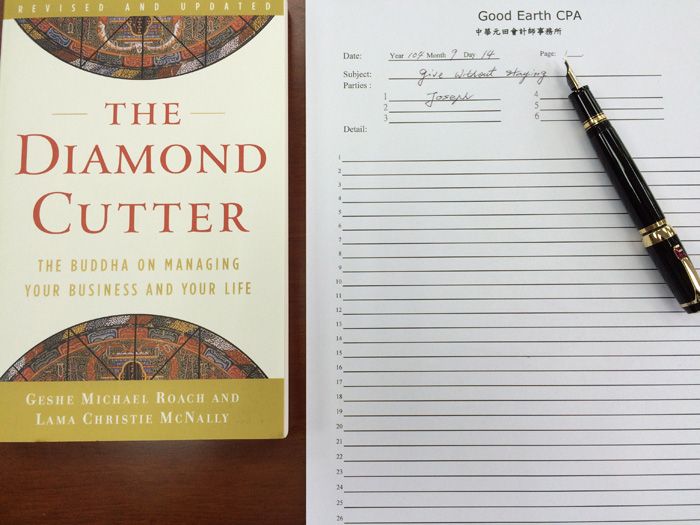

A foreign investor must engage a Taiwanese agent, either a Certified Public Accountant (CPA) or a lawyer, to file investment and incorporation papers on behalf of the foreign investor, either an individual or a legal entity.

In general, six government agencies and a bank will be involved during investment and incorporation procedures:

- Investment Commission MOEA – Foreigner Investment Approval

- A bank account for the registered paid-in capital

- Ministry of Economic Affairs (MOEA) – Incorporation filing

- Bureau of Foreign Trade – Import and Export License

- National Taxation Bureau – Company Business Registration and Tax ID Number

- Bureau of Labor Insurance – Company Labor Insurance and Pension Account

- National Health Insurance Administration - Company National Health Insurance (NHI) Account, and 2nd NHI Account

Upon completion of its incorporation, the newly set-up company can start doing business, but the Value Added Tax officer of the jurisdiction where the company is registered is required to meet with and verify the identity of responsible person or his/her legal representative.

After verification is complete, the VAT officer will issue an approval for the company to purchase Government Uniform Invoices (GUIs), which are pre-numbered VAT Invoices; these are the official invoices that a business entity issues to its customers for any transactions in Taiwan.

To keep competitiveness and optimize net profit, one of the key tasks of a foreign investor is to accurately estimate the tax burden of a company in Taiwan.

In general, Taiwan Tax Laws and Tax Rates, either Income Tax or VAT (GST), are reasonable and friendly, but Taiwan is still a developing country, in many different ways. Taxes are one of these ways; in many cases, tax litigation can arise from a situation that has not been clearly defined by tax law. This is a subject for concern when a company attempts to apply tax law to a transaction without consulting a reliable tax advisor.

For international transactions, a company must evaluate tax compliance from the point of view of Taiwan tax law, tax incentive scheme, tax treaties, and take into account the proficiency of the local tax officer with regard to cross boarder transactions.

In order to avoid, or at least to reduce, the tax risks to foreign investment, a foreign investor or his/her tax agent should always maintain a smooth relationship and communication channel with local tax authorities, either at ministry level or at city level.

Following are the taxes generally applicable to a Taiwan Private Limited Liability Company and the tax compliance requirements which a Taiwan company needs to adhere to in order to comply with Taiwan tax laws and regulations.

- Tax Overview

Corporate (Business) Income Tax

The earnings, and accrual basis, of a Taiwan LTD are subject to:

- Corporate (Business) income tax. The currently applicable corporate income tax rate is a flat rate: 17%. If the annual net profit before income tax is less than TWD120,000 ( Approx. EUR3,000), the net profit is tax free.

- There is no surcharge, such as the 5.5% solidarity surcharge seen in some European countries.

- There is no Trade Tax, such as is found in some European countries. For example in Dusseldorf, Germany the trade tax could be 3.5% X (annual taxable income of your company) X (municipal multiplier of 440%)!

The taxable income is usually higher than the profit calculated according to Taiwan or international reporting standards, due to non-deductible expenses or differences in valuation of assets and liabilities. Generally, it can be said that the total tax burden on an LTD amounts to a bit more than 17% of the profit before taxes, but not much.

Filing Corporate Income Tax Returns and Remitting Provisional Income Tax (Tax Advance Payments)

Corporate income tax is filed and assessed annually, based on the LTD’s cumulative transactions of the calendar year, usually January 1 through December 31. Tax authorities require that Provisional Income Tax for the current year be paid in advance based on the income tax paid for the previous year. The advance payments must be made, on the following schedule:.

- Corporate annual income tax for the previous year is filed and paid from May 1 to May 31, with no extension allowed.

- Provisional Income Tax for the current year is filed and paid from September 1 to September 30, with no extension allowed. (This schedule may be in contrast to that in other countries. In Germany, for example, these payments are made quarterly at legally fixed dates.)

- No Trade tax

In general, the Taiwan tax year is the calendar year, but subject to advance approval, a business entity can be allowed to adopt special accounting year.

- Value-added tax (VAT) - Goods and Services Tax

Value-added tax (VAT) applies to all business transactions in Taiwan, i.e., goods delivered and services provided in Taiwan. The normal VAT rate is 5%. But a reduced VAT rate of 2% or total exemption may be applicable to certain daily goods and services, such as raw agriculture food, newspapers or social welfare services. Exported goods and services enjoy a “0” rate VAT and VAT input refund.

Monthly or Bi-monthly Value-Added Tax (VAT) Returns

In Taiwan, a newly established company is obliged to file monthly or bi-monthly VAT returns (Form 401) and to pay the computed VAT to the tax office at the same time. The filing deadline is the 15th day of the following month, with no extensions allowed. A business entity must declare its monthly or bi-monthly expenses and revenues, even when no sales are made and/or no expenses incurred.

Taiwan does not adopt a preliminary VAT return system. For example, in Germany, after two years of incorporation, the filing period for preliminary VAT returns will depend on the amount of o VAT accrued for the previous year. If the amount is lower than €7,500, the VAT returns can be filed quarterly. In Taiwan, all business entities must file VAT returns, either monthly or bi-monthly from the day the company’s Tax ID number is assigned.

- Withholding Tax Statement

The distributions of dividends, salaries, service fees to professionals, royalty payments, and interest by a Taiwan business entity are subject to withholding taxes. The reports, along with collected withholdings must be filed and paid to the tax office by the 10th of the month for each preceding month, with a comprehensive annual report due the following January.

The following are the withholding rates for dividends, royalties and interest:

| Country |

Dividends |

Interest |

Royalties |

| Non-treaty Countries |

20 |

15,20 |

20 |

| Australia |

10,15 |

10 |

12.5 |

| Austria |

10 |

10 |

10 |

| Belgium |

10 |

10 |

10 |

| Denmark |

10 |

10 |

10 |

| France |

10 |

10 |

10 |

| Gambia |

10 |

10 |

10 |

| Germany |

10 |

10,15 |

10 |

| Hungary |

10 |

10 |

10 |

| India |

12.5 |

10 |

10 |

| Indonesia |

10 |

10 |

10 |

| Israel |

10 |

7,10 |

10 |

| Kiribati |

10 |

10 |

10 |

| Luxembourg |

10,15 |

10,15 |

10 |

| Macedonia |

10 |

10 |

10 |

| Malaysia |

12.5 |

10 |

10 |

| New Zealand |

15 |

10 |

10 |

| Netherlands |

10 |

10 |

10 |

| Paraguay |

5 |

10 |

10 |

| Senegal |

10 |

15 |

12.5 |

| Singapore |

40* |

NA |

15 |

| Slovakia |

10 |

10 |

5,10 |

| South Africa |

5,15 |

10 |

10 |

| Swaziland |

10 |

10 |

10 |

| Sweden |

10 |

10 |

10 |

| Switzerland |

10,15 |

10 |

10 |

| Thailand (Thai text) |

5,10 |

10,15 |

10 |

| UK |

10 |

10 |

10 |

| Vietnam 15 10 15 |

15 |

10 |

15 |

- Transfer Pricing Documentation

In due course, a transfer pricing report must be submitted. This report will be required latest in a field tax audit by the local tax office. When requested by the tax authorities, the transfer pricing report has to be presented within 30 days. According to Taiwan tax laws and international tax principles, any transaction conducted between related parties in a cross-border relationship has to be consistent with the “arm’s length” principle. Compliance with this principle must be documented in the report.

Business relations between foreign parent and affiliated companies and the local company should be based right from the beginning on proper agreements (in written form) and the participants should execute business in accordance with these agreements.

The question of transfer pricing can present considerable tax risks. However, solutions are far less complicated if legal constructions are discussed in advance and customized to your individual requirements.

Taiwan business entities follow Taiwan Generally Accepted Accounting Principles, which is similar to US GAAP. However, since 2008, Taiwan has started amending Taiwan GAAP according to International Financial Report Standards (IFRS). From 2015, all the business entities must follow IFRS.

- Salary Taxes and Employee Social Security

A Taiwan LTD, as any employer, is responsible for timely and correct calculation of salary taxes and social security contributions, which include NHI, 2nd NHI, Labor Insurance, and employee pensions, and the monthly payment of the withheld amounts to the tax office and the insurance company. Salary tax is calculated on a cash basis.

In general, the employer contribution to employee social security is about 15% to 20% of the monthly salary paid to employee.

Note that for foreign employees or managers, the withholding rates and filing procedures are different from those for local employees.

Navigating the legal waters to set up a business in Taiwan is less cumbersome than in numerous countries, and many foreign entities have done so successfully and very profitably. Of course having a trusted pilot to guide the way always helps.

|